Strengthening the leading position in instalment sales in Poland

![]()

STRENGTHENING THE LEADERSHIP POSITION

EXIMEE PLATFORM

EVERYTHING ONLINE

01. Client

The history of Credit Agricole dates back to the end of the 19th century, when the first fund of the Société de Crédit Agricole association was established. For Credit Agricole, the 20th century was primarily about building a nationwide reach in France, and at the beginning of the 21st century its international expansion began. It has led to Credit Agricole Bank becoming the first bank in France (28% of the market) and the second largest in the world in terms of revenues.

The cooperation between Credit Agricole and Consdata started with the application form for the government's "Family 500+" program. Shortly afterwards, the bank decided to replace its own application for installment loan with a new one, based on the eximee platform, similarly to the "Family 500+" process.

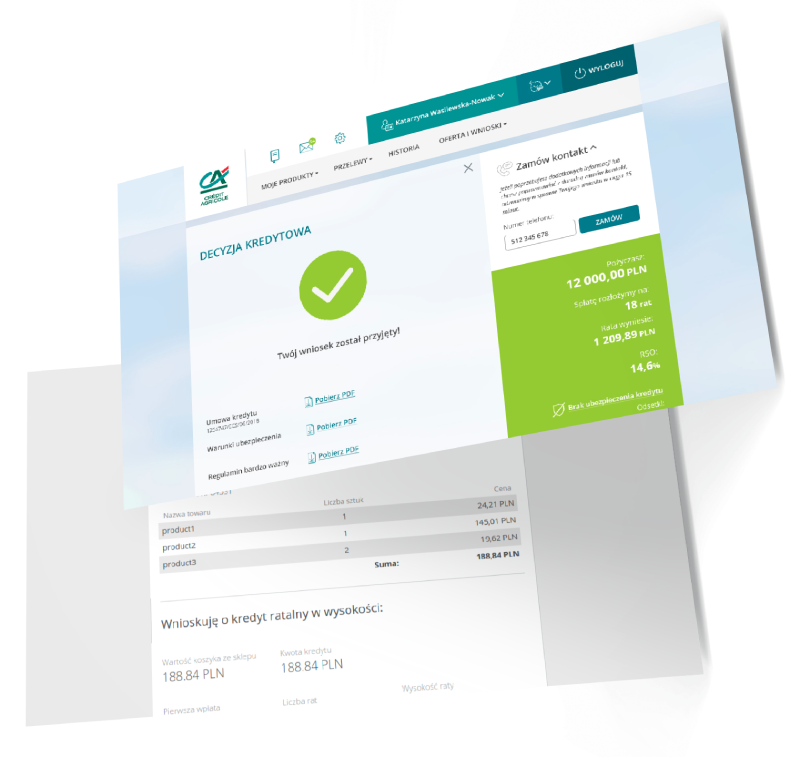

Our task was to create a solution that would enable customers to initiate the process of applying for installment loan right after finishing online shopping and confirming an order. In the shortest possible path, the process may take less than 15 minutes from the moment a customer makes a purchase in the online store to the end, i.e. to confirming the installment loan contract. In alternative paths, however, it was necessary to ensure that the customer could return to the application process that had been suspended due to, for example, a longer time of issuing a credit decision.

Challenge

Our task was to create a solution that would enable customers to initiate the process of applying for installment loan right after finishing online shopping and confirming an order. In the shortest possible path, the process may take less than 15 minutes from the moment a customer makes a purchase in the online store to the end, i.e. to confirming the installment loan contract. In alternative paths, however, it was necessary to ensure that the customer could return to the application process that had been suspended due to, for example, a longer time of issuing a credit decision.

02. Solution

The main features of the new loan application are: integration of the application form with the bank workflow process, merchant online stores and the BlueMedia mechanism which confirms customer identity by bank transfer, as well as authorization of the application by sms (OTP) password.

A dedicated mechanism was developed that allows the customer to return to the application process (after OTP authorisation) at any time.

Hierarchical design of the application form and the possibility of using its elements also allowed for quick delivery of a credit simulator based on the same mechanisms as the application, which can be used by shoppers before placing an order.

Worth mentioning

Worth mentioning

Purchases using Credit Agricole's offer are the favorite loans of Poles. This is the result of research conducted by the Office of the Economic Zone - an appendix to the Dziennik Gazeta Prawna newspaper.

Credit Agricole is a leader in installment payment systems in Poland. Credit Agricole's installment loan is the most recognizable installment system on the market - almost 68% of respondents answered this question.

03. Results

The main benefit was that the customers of online shops could immediately apply for instalment loan and finalize the application within 15 minutes.

Currently, around 300 shops use this solution.