Selling banking products

Efficient omnichannel sales process

Modern and aesthetically designed components

Clients

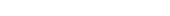

Effective onboarding

Today's customers expect technologies that simplify the sales application process as much as possible. You can adapt to their expectations by designing applications such as opening a personal or corporate account, as well as a credit card or loan application etc. Customers will be able to use the technology such as:

- Customer biometric identification

- Automatic verification of the authenticity of the attached documents

- Integration with authorising transfers

- The client's data reading from the ID document

- Retrieval the data about credit commitments from credit reference agencies and public credit registers

- and many others.

You increase the conversion from filled in applications, because you shorten the time of filling in to the necessary minimum, simplifying the whole process!

Application in the form of a conversation

Make the client, when filling in the application form, talk to it as if it were a bank employee. Such a form affects the level of satisfaction and increases the conversion of the application. Build the application based on the dialogue with the client, leading it from one question to another. Let the client decide about himself and you will increase your sales.

You can also influence the process of building positive relations with clients through a dynamic and personalized application form ("Martin, congratulations! You can now use your account.")

Focus on the ergonomics of the application and its smooth and quick filling in. Analyze the customer journey path. Make changes and increase sales.

Monitoring helps boost sales

Monitor the quality of applications and eximee processes on an ongoing basis.

Record all application statistics, as well as interaction data on individual pages and fields. Find out which applications (or their individual sections) have been filled in the longest and which fields most often cause validation errors.

This allows you to capture and eliminate elements or solutions that cause problems for your customers.

Immediate reaction to abandonment of an application

Your banking can draw on the best practices used for years in e-commerce. Just as online shops monitor abandoned shopping carts, with the eximee Platform your bank can effectively respond to abandoned forms and increase your conversion rate.

The moment the customer stops filling in the application form, the information is immediately captured and can be transferred to the banking call center. The sales support team is then provided with all legally permitted data from the application, such as the type of application, customer profile and the value of completed fields. Thanks to this, the call center knows what the customer was interested in and can adjust the communication accordingly.

In this way you can recover up to 22% of your customers who abandoned the application!

Integration with the backend of the bank

Integration of a sales application with the bank's backend systems enables its dynamic adjustment to the current parameters of products, promotional campaigns or cross-sell options.

It is also possible to fill in an application synchronized with the banking workflow system, to which an update of the process status is sent on an ongoing basis (e.g. after each step of the application).

Do you have any questions?

Contact us

Consdata S.A.

ul. Bolesława Krysiewicza 9/14

61-825 Poznań

Poland

tel. +48 61 41 51 000

email: sales@consdata.com

Tomasz Ampuła

Product Owner, Digital Transformation Expert

tel. +48 783 211 611

email: tampula@consdata.com