Digital sales transformation in PKO Bank Polski

OMNICHANNEL

EXIMEE PLATFORM

A HUGE SUCCESS

The reason why PKO Bank Polski has come through digital sales transformation.

PKO Bank Polski has been the largest, oldest and most recognized bank in Poland for a hundred years. This fact was also a kind of burden for this institution. Well, since the beginning, this oldest bank had mainly focused on selling banking products in branches. It is clear that many years ago all banks operated in this way. However, the world has changed, the digital revolution has come, but PKO Bank Polski still realized the vast majority of sales in branches even when there were already fully online banks on the Polish market.

Since 2010, PKO Bank Polski has been implementing its digital transformation strategy. The aim is to make the bank more accessible to its customers through digital channels. The digital transformation has been even more focused on the next long-term strategy for 2016-2020. One of its pillars was distribution excellence, i.e. accessibility always and everywhere. This pillar was described as follows: "Modernising the network and ensuring consistent customer experience across contact channels as a way of achieving customer satisfaction and maximising sales interaction".

The cooperation between PKO Bank Polski and Consdata was initiated by the goal of maximising sales interactions. In 2016, the bank said directly to its customers: "we want to make it possible for you to buy our products in a consistent and most convenient way. Whether it's an internet channel, a mobile channel or a traditional branch." In its strategy, the bank also stated that in order to achieve this goal, it will require another strong pillar. It was operational efficiency. It was related to process optimization. It was literally defined as "faster and without paper". Therefore, in 2017, the bank started the SMARTOP project, which concerned the digitisation of sales and service processes, strengthening the role of remote channels and eliminating paper documents from the processes as much as possible.

However, the Bank was aware of how such sales processes should be developed. Top management knew that such changes must last for months or maybe even years. It was crucial to design different processes and run them in many channels at once. These channels were based on different technological infrastructure. It was different for electronic banking and for mobile applications.

This was the moment when our company appeared in PKO Bank Polski to implement its digital sales transformation strategy. The bank selected us to cooperate in the creation of the client's onboarding process, to be more precise the process of opening a bank account. Consdata was chosen for this project, among other things, because of previous implementation successes in banks such as mBank.

Onboarding in PKO Bank Polski

This first phase of cooperation between Consdata and PKO Bank Polski ended as a double success. Firstly, the onboarding process was launched for both electronic banking and the mobile channel. The second success was more important. Well, the bank's employees found out that omnichannel sales in the bank is really possible to achieve. They began to believe in the capabilities of the eximee platform, which was able to unify the development and implementation of the sales process regardless of the channels of distribution. This was an even greater success than the onboarding implementation itself. From that moment on, the distribution channels were no longer a barrier for the bank. The whole process of digital sales transformation in PKO Bank Polski, with the participation of Consdata, gained a fast pace.

Next phases of our cooperation with PKO Bank Polski

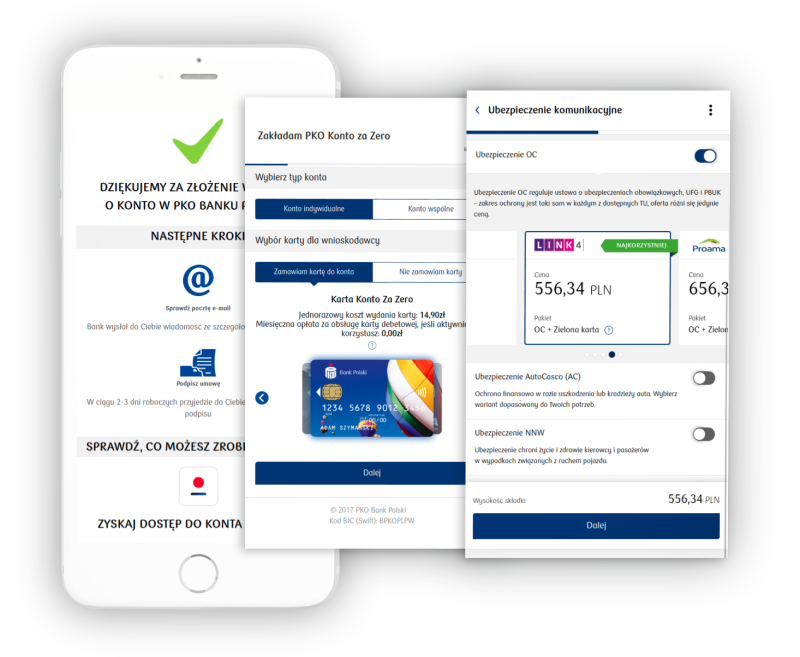

When PKO Bank Polski became convinced that it is possible to launch consistent sales processes in different channels, the Bank decided to prepare further sales processes. All the work was done on the eximee platform implemented by Consdata. During two years of cooperation, in addition to opening a personal account, the bank also launched processes:

- opening a company account for SMEs

- cash loan sales

- motor insurance sales

The bank, which already had a tool to design and publish sales processes in different channels, decided to go one step further. The bank developed an internal procedure, on the basis of which, data from the eximee platform about the abandonment of the process by the customer, started to be transferred to the call center to call back and recover the customer.

Successful sales digitisation in PKO Bank Polski

One of the undoubted successes of using the eximee platform is the financial one. In 2019, the bank accelerated the completion of its cash loan sales plan by 400%. The solutions provided by Consdata played a significant role in the total sales and financial results from the remote channels. PKO Bank Polski was proud of these results during the conference at which the bank presented its new strategy for the years 2020 - 2022:

(5% 1Q 2017 vs 28% 3Q 2019)

which is an increase of 21%

(3Q 2016 vs 3Q 2019)

Do you have any questions?

Do you want to achieve similar results? Contact us.

Consdata Sp. z o.o.

ul. Bolesława Krysiewicza 9/14

61-825 Poznań

Polska

tel. +48 61 41 51 000

email: sales@consdata.com

Tomasz Ampuła

Product Owner, Digital Transformation Expert

tel. +48 783 211 611

email: tampula@consdata.com