Since the beginning, in Consdata we have been taking an active part in digital transformation of banking. But the very concept of "digital transformation" did not appear suddenly. This term has been used at all major banking conferences for years. However, the context in which it was pronounced was different. Until 10 years ago, there was more talking about digital banking transformation in terms of plans for the future than strategies ready to be implemented. Today, the largest banks participating in events such as EFMA Innovation Summit, are eager to boast of their successes related to the strategy of digital sales and customer service. But is the state of digital transformation so good that we can already open champagne? It turns out - it's not.

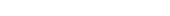

Digital transformation: From silos to omnichannel

But let's start with a summary of what it is. Before the transformation phase, the bank's organisation is in a kind of silos. The exchange of information between these silos is difficult and each department implements new solutions individually, without an overarching strategy. The biggest problem in selling banking products is the lack of a unified solution enabling publication of processes and products consistently in sales channels. Each of the distribution channels has individual processes, interfaces and published content independent of other channels. Then, for example, the process of onboarding is practically impossible to implement on a website and in a mobile application at the same time and in the same way. This is because most often the team working on web onboarding is a different team than the one implements onboarding in a mobile application. And even if it is the same one, it is not able to use the same technologies, which usually implies that processes will be different in both channels.

Digital transformation changes this model into a new one, in teams are self-sufficient, self-organizing and responsible for well-defined areas in all channels. They should be, however, equipped with a channels-wide solution which takes responsibility for factors and task common for all the teams. Basically, it should provide Customer Experience with all its elements that can be used (and re-used) by all teams, no matter what products or process they develop or maintain. This also means that they work (and think) in cycles or iterations independent from other teams.

Digital transformation in banking over the years

Let's take a look at how the approach to digital transformation from banks around the world has changed over the past few years. I will use three studies to show this:

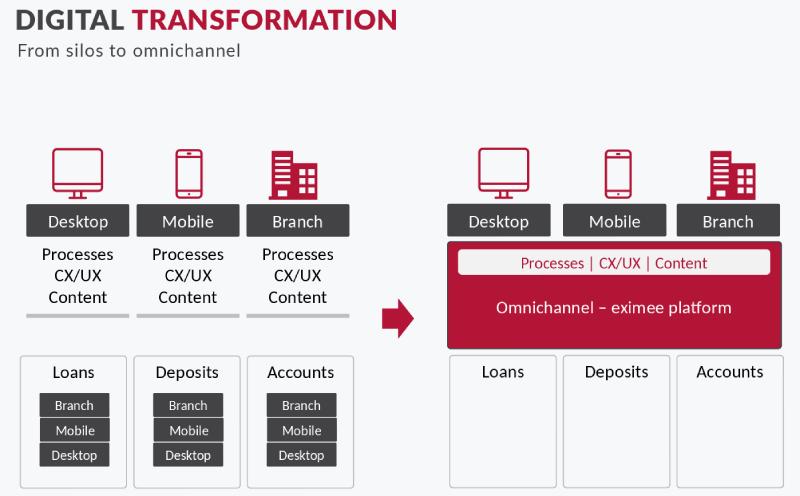

The results of the GFT survey showed that in 2017 only 34% of banks in the world had a defined strategy of digital transformation. More than half of the banks (53%) were at the stage of its creation, and 13% had not yet started to think in this direction. As it can be assumed, a better situation was diagnosed in large, global banks (employing more than 10,000 people). More than half of them had already defined their strategy during the survey. Definitely worse were small banks, where as much as 78% were at best at the stage of creating the strategy.

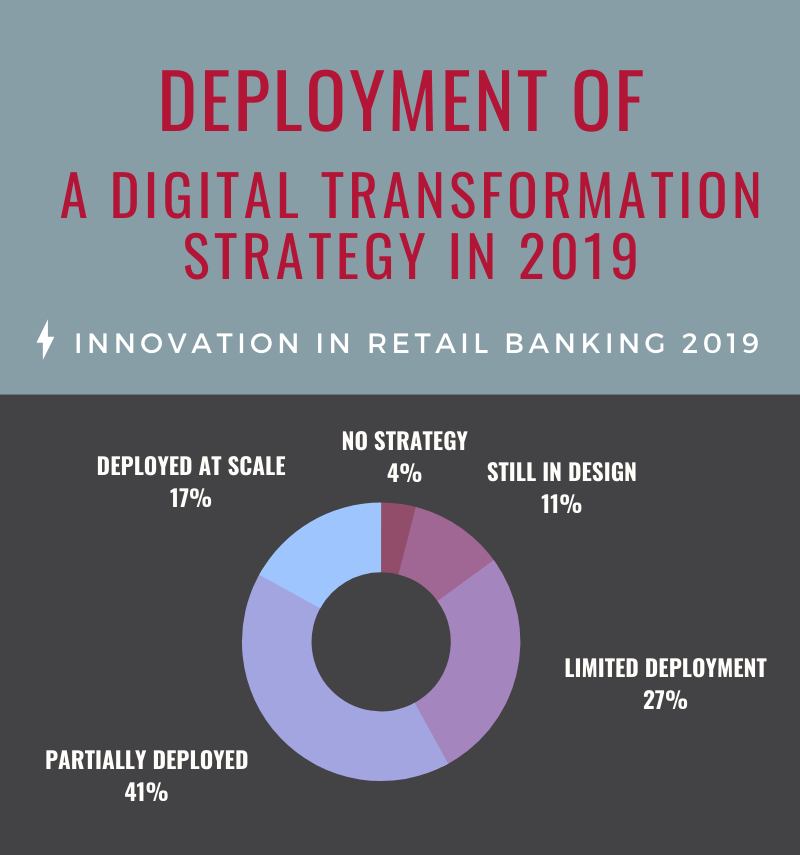

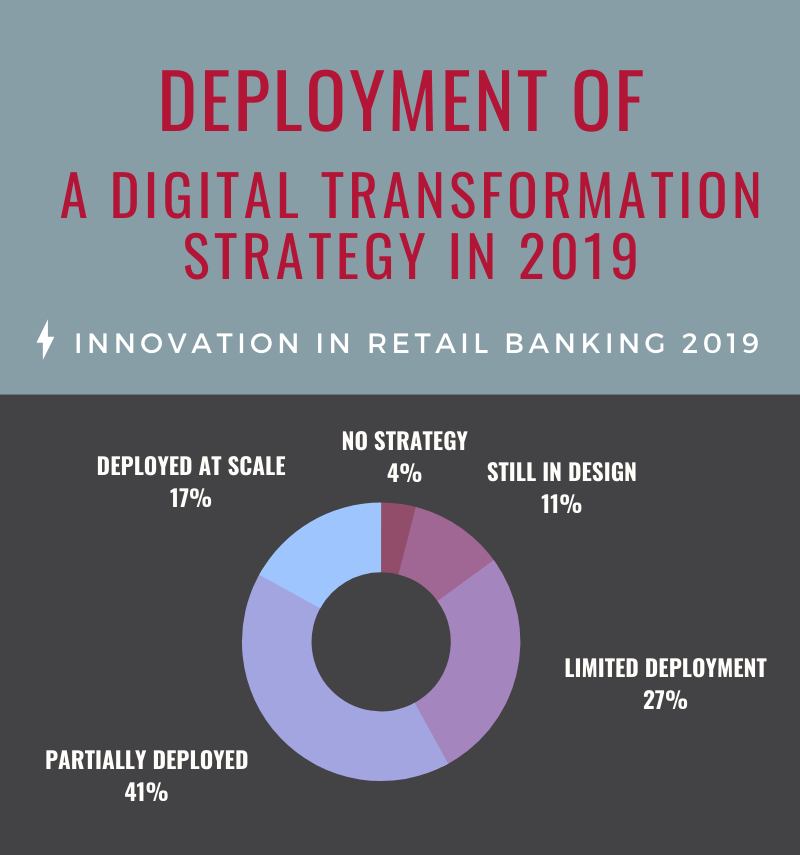

The latest report "Innovation in Retail Banking" from October 2019 shows the state of digital transformation not from the point of view of defining the strategy, but its execution and implementation. Only 17% of banks in the world are now able to boast that they have implemented a full scale digital transformation strategy. The largest number of banks, i.e. as many as 41%, have partially implemented the strategy, and 27% of banks are at the initial stage of its implementation. Interestingly, 11% of banks are still at the stage of defining their assumptions, and 4% have not even passed this stage at all.

The latest report "Innovation in Retail Banking" from October 2019 shows the state of digital transformation not from the point of view of defining the strategy, but its execution and implementation. Only 17% of banks in the world are now able to boast that they have implemented a full scale digital transformation strategy. The largest number of banks, i.e. as many as 41%, have partially implemented the strategy, and 27% of banks are at the initial stage of its implementation. Interestingly, 11% of banks are still at the stage of defining their assumptions, and 4% have not even passed this stage at all.

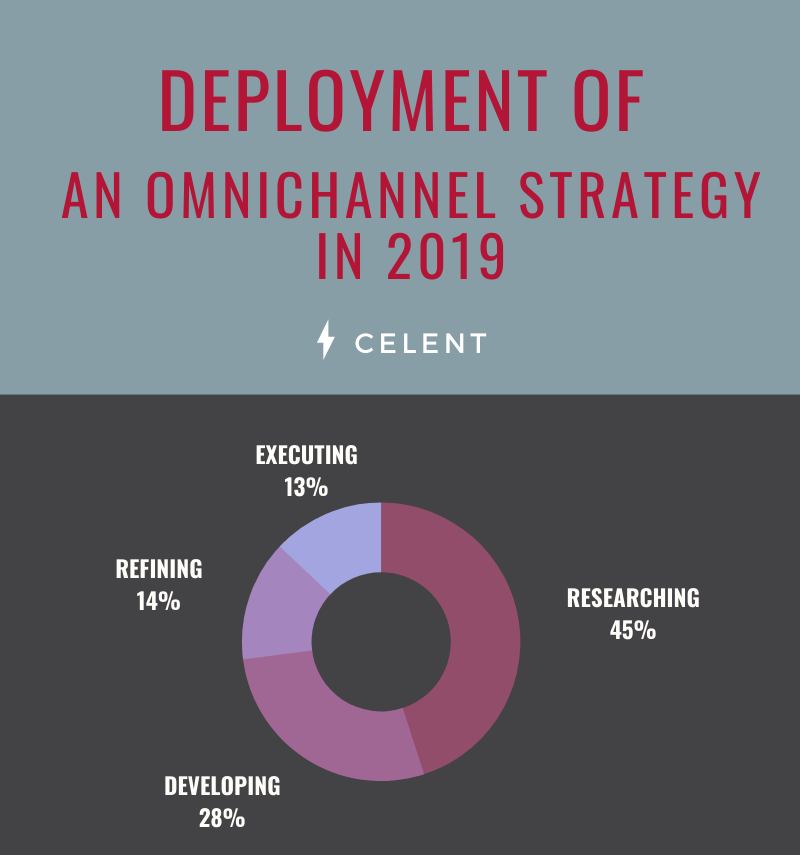

If we assume that the omnichannel strategy in banking is part of a larger digital transformation strategy, the results achieved by Celent are not surprising. It turns out that in 2019, only 13% of banks fully implemented the omnichannel strategy, 14% are in the process of refining it and 28% are still developing it. However, the largest group of banks (45%) are at the beginning of this road and are just now searching for opportunities to implement the omnichannel. Comparing the Celent study to GFT from 2017, it is noticeable that with the size of the bank, the percentage of institutions that are already ready with the strategy and its implementation increases. However, we are still talking about some banks worldwide.

It takes years from the creation of the strategy to its implementation

The strategy of digital transformation in banks cannot be implemented as with the touch of a magic wand. It takes time, counted in years, not in months. It takes time from the moment of defining the strategy to its full implementation. This statement leads to two main conclusions, one positive and one ...difficult.

Let’s start from the latter. Digital Transformation is not an action, it’s a process. In banks usually it takes years, so it is important to realize that the currently defined digital transformation strategy will be constantly changing. You cannot fully rely on the assumptions you made a year or two ago. Transformation is inseparably connected with the implementation of new IT solutions in the bank. It is worth mentioning that the current half-life of the requirements for the IT system is about 6 months. This means that after half-year, half of the requirements will become outdated. Only agile adaptation of requirements and their implementation in iterations is able to prevent the fiasco of the whole transformation.

Positive, however, is how far in digital banking transformation you are. If your bank is among the few institutions that have gone through the whole process of defining a strategy and implementing it on a full scale - you are among the best. You are simply a leader in the industry. However, if these things are just happening in your bank, look at it as a glass half full, not half empty. You are not the only one. You are in the majority, and the successes you hear about at conferences should only motivate you to follow the path you’re on. Even though it sometimes it feels like trail blazing.

How to find out how far in digital banking transformation are you?

There is no clear answer to this question. However, based on our experience in implementing digital transformation processes on mature Polish banking market, we have prepared a checklist. The more positive answers you give, the more digitally advanced is the bank you work for. So think for a moment:

- Are your teams divided into functional (product) groups rather then into silos - channel-related groups?

- Do you have a solution that unifies and standardizes CX and customer journey in all sales channels?

- Can customers get immediate access to the products they just bought with your sales process?

- Do your teams focus on processes which are separated from technology and channels the processes are published in?

- Can your processes be stopped and resumed later in a different channel, by a customer or bank employee?

- Do you instantly catch abandoned processes and contact your customers to encourage them to finish the processes?