- What does the research show about the quality of service in the banking sector?

- Conclusions emphasized by Capgemini specialists

- Where do I start? What should I do?

- What about chat bots, virtual assistants or gamification?

- Change is a cycle, not a finished process

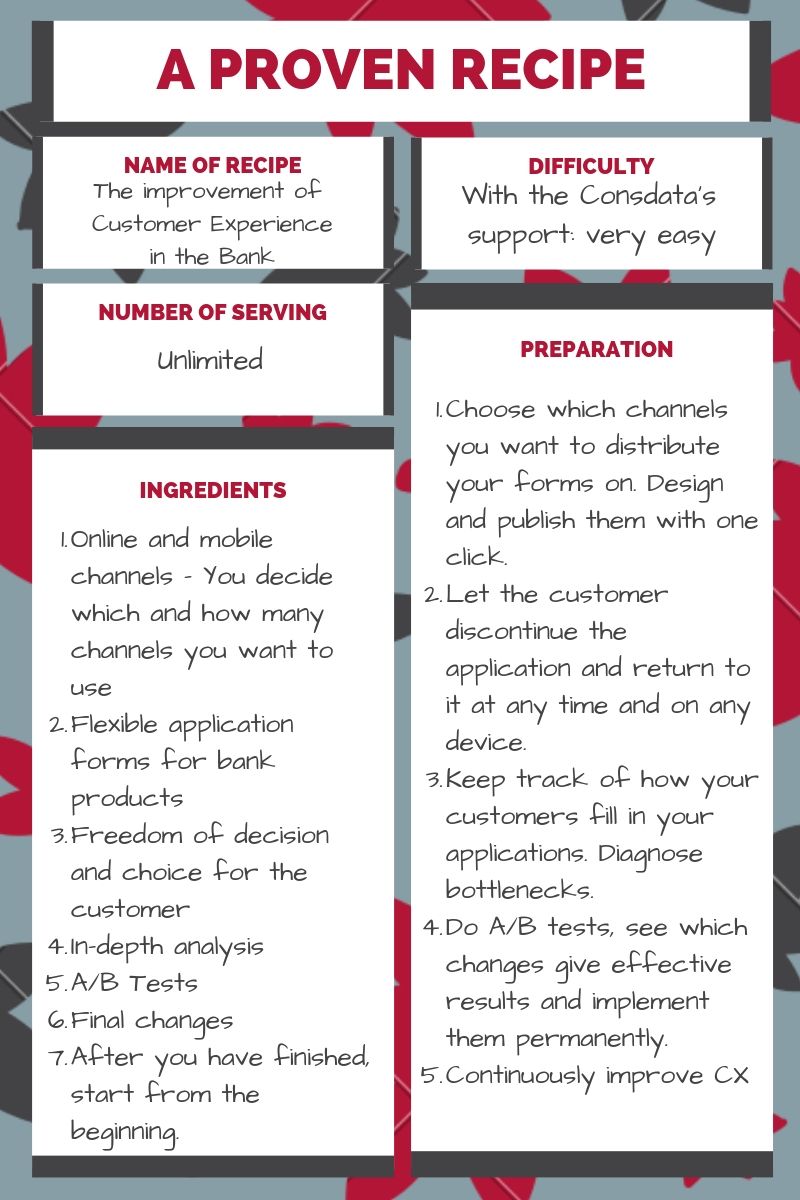

- A proven recipe for improving Customer Experience in a bank

- And finally... recover up to 22% of your customers from lost applications!

In this article we decided to take a closer look at one chapter of the Capgemini World Retail Banking Report 2018. This report makes the reader think about the way his bank functions in terms of Customer Experience. However, it does not ultimately suggest any solution that could be applied almost immediately. We decided to meet this challenge and prepared a short recipe for how banks could improve customer service and at the same time improve sales conversion in the Internet and mobile channels.

What does the research show about the quality of service in the banking sector?

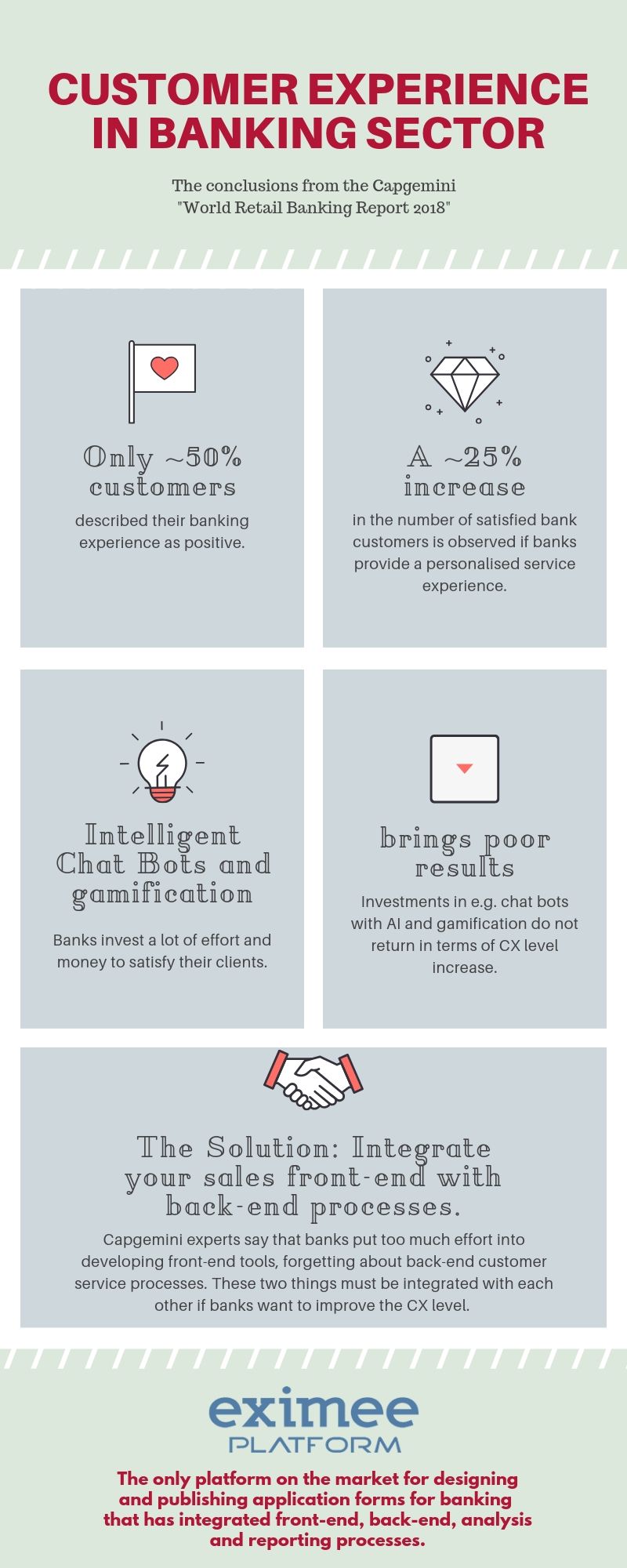

The Capgemini report clearly shows that there is still a small percentage of customers who are satisfied with the quality of their experience with the bank. Only about half of the surveyed bank customers described their banking experience as positive. The exact figures depend on the channel of contact between the customer and the bank. Thus, 51.1% of people are satisfied with the experience of visiting a branch, 46.9% with using bank mobile applications and 51.7% with e-banking on the Internet.

Bank customers value the ease and convenience of use the most. The above answer was most often given when asked about the factor that causes them to want to stay with their current bank for another year (56.7%), and also when asked about the factor that customers consider when choosing a new bank (47.3%).

Another important factor building positive Customer Experience is the personalization of customer service. It turns out that customers who experience customer service personalization are more satisfied with service (49.1% of customers are satisfied) than customers whose banks do not personalize service (only 39.5% of satisfied customers). Comparing these figures with each other, it turns out that service personalisation contributes to an increase in the number of satisfied customers by nearly 25%.

Conclusions emphasized by Capgemini specialists

Experts from Capgemini emphasize that the expectations of bank customers in the area of Customer Experience are very high and are based on experience from other industries. It is not surprising, therefore, that banks invest a lot of effort and money to meet their customers' needs. The report mentions several examples of such investments of specific banks, in solutions such as chatbots with artificial intelligence or the use of gamification. Despite many solutions of this type existing on the global banking market, investments in customer service technologies do not return to banks in the form of a high Customer Experience level.

Capgemini specialists warn that such a situation results from improper allocation of investments. It turns out that banks pay too much attention to the improvement of their front-end interfaces, which are visible in the first line of contact between the customer and the bank, while forgetting about back-end customer service processes. These are the places where banks should focus at the moment - building and optimizing processes that affect Customer Journey and customer service.

The core is therefore a more comprehensive customer service oriented approach that integrates back-end with the front-end that the customer encounters at a first sight. In order to prove that such action brings measurable results, Capgemini specialists used examples of companies that managed to break the status-quo in their industries and build the client's experience anew. Although Amazon, Uber and Netflix did not reinvent the wheel, they did change the quality of customer service in a noticeable and unusual way.

Where do I start? What should I do?

Reading the Capgemini World Retail Banking Report 2018 does not bring the reader any solutions to this state of affairs - because it cannot. The report must be objective and must not be associated with any technology provider, as it would cease to be valued in the banking world. However, we, as Consdata, can afford a little less objectivity, supported by the experience gained from one of the most technologically advanced banking markets in the world – Poland.

Think about where you are selling or reselling new products to grow the real income of your bank. These are the applications that the customer fills in when applying for a new banking product. Even if the bank's employees perform fantastic work through customer segmentation, creating a dedicated offer based on credit scoring, as well as appropriate communication and advertising of the offer to the customer, the customer is finally directed to the application that needs to be filled in. First of all, you should focus on the element that will not only ensure an excellent Customer Experience level, but will also have an impact on the bank's financial result.

What about chat bots, virtual assistants or gamification?

It is true that if such technological novelties were not important, global banks mentioned in the Capgemini report would not invest in them. However, in most cases these technologies do not create a sales frontend and do not affect the back-end processes mentioned by experts. It is much simpler and more effective to influence these processes by adjusting the applications for banking products. You should be most interested in conversion from an application. A satisfied customer is a customer who can efficiently fill in an application for a bank product and at the same time receive the possibility to personalize banking services.

Change is a cycle, not a finished process

Before we start making changes to the CX and UX of your applications, let's discuss the approach to working on them. From our experience in working with the largest banks in Poland, we can say that the Deming Cycle does a great job for this purpose. In fact, it consists in continuous improvement of processes within a closed circle consisting of 4 stages: Plan - Do - Check - Act. Realizing that the process of change is not complete, but continuous, allows you to constantly look for opportunities for change and improvement, and thus creates competitive advantages.A proven recipe for improving Customer Experience in a bank

PLAN

1. Select and schedule channels

Decide which products your customers can apply for on their own and in which channels. Plan how the omnichannel idea should work in your bank.

DO

2. Design flexible applications available in each channel

If you want to provide your customers with a true omnichannel experience, you should have a technological basis for it. One of these pillars is the tool for creating flexible conclusions that can be published simultaneously in multiple channels (e.g. website, mobile application and backend available for call center).

3. Give your customers choice and freedom

Make it possible for your customers to discontinue and save the application at any time during its completion. Allow your customers to return to it using another device or even a call center. Let the customer decide how to complete the application.

CHECK

4. Study all that' s possible

Keep track of how your customers fill in your applications. Diagnose bottlenecks and elements that prevent clients from finalizing an application or even cause it to be abandoned. Examples of such actions and Success Story of our Customer mBank have been described in a separate article about data analysis while taking care of Customer Experience.

ACT

5. Make changes

As soon as you identify places to improve - act! Make changes immediately or study their impact through A/B tests. A great example of such an approach is the mentioned in other article mBank and their Success Story.

And finally... recover up to 22% of your customers from lost applications!

Yes, it is! One of our articles was dedicated to describing how to recover lost customers. The described method of increasing conversions from e-banking applications works not only for our customers, but also finds its global confirmation. Draw on the experience of others and increase your bank's revenues.