- Customer Experience: How does marketing measure it?

- What is the point of such research in marketing?

- Customer Experience in online banking

- How to take care of Customer Experience in banking electronic applications?

- Significant benefit for banks in the Customer Experience measurement.

- What data can be collected and analyzed when filling in electronic banking applications?

- Success Story mBank

If there is something that modern banking can learn from modern marketing, then it is definitely an approach to deep data analysis in Customer Experience measurement. The real boom for data analysis and drawing conclusions from it in marketing started years ago from Google Analytics and continues to this day. Currently, hundreds of start-ups and large technology companies are competing to provide marketers with newer and newer tools that allow them to measure, aggregate and examine every single online customer movement, even the smallest one, and then draw conclusions about its real impact on business. In the same way, banking should measure customer experience. And even if you already use some things listed in this article below in your bank, we hope we will inspire you to think further and optimize your processes.

Customer Experience: How does marketing measure it?

The above-mentioned Google Analytics together with Google Search Console are just the tip of the iceberg, which contains the analytical capabilities of modern marketing. Both tools collect and process general data from the website, after which we can investigate how users of the website statistically click through it and what are the sources of traffic on the website (this is just a short description, because training on these tools often lasts a few working days).

The data obtained from the above systems allow us to draw conclusions about the changes that could be made to improve Customer Experience and usability of websites. However, they do not provide full information about how a particular user passes through the page on which element he stops, what attracts his attention. For such research, marketers use marketing automation class systems (this is one of hundreds of functions available in this type of software), as well as tools such as Hotjar. Hotjar literally records the visits of a particular client on a website and the movements of his or her mouse, creating heat maps of the website.

Marketers, however, are faced with a considerable limitation in the context of Customer Experience measurement on websites. Many tools provide in-depth data on website users. However, due to the existence of GDPR and protection of customer privacy, collected data from different analytical systems often cannot be combined with each other and processed by big data mechanisms.

What is the point of such research in marketing?

Basically, to improve the Customer Experience of website users. Today's modern customers start their search for products or services on the Internet. Very often this journey ends with shopping on the Internet. In a competitive market, the winner is the one who delivers the product both at an affordable price and in a way that encourages the customer to make a purchase on this particular website.

In practice, it all comes to a deep analysis of all the areas and subpages of the website. Marketers analyze where customers click and how their journey through the website goes. They identify bottlenecks, i.e. places where they lose their customers - at what moment and in what place the customers stop and do not go any further, e.g for example by switching off the website.

The data collected in this way allows marketers to make smaller or larger changes on the website, improving the Customer Experience, leading them to the conversion that business owners expect. Changes are often driven by the desire to test whether its introduction will have a real impact on Customer Experience and website conversion. Such tests have their own name - A/B. The assumption of A/B tests is to make a single change and observe how customers will react to it, compared to a control group that uses a website without a change. If the differences are significant and have a positive effect on the conversion, the change is approved for all users.

Customer Experience in online banking

This quite long introduction has its justification. Probably in a similar way you research the conversion of Internet and mobile channels of your bank. However, no matter how many marketing and sales activities (both online and offline) you take to encourage the customer to apply for a new banking product, the customers will finally come to the application form. In such case, only successful completion of the application for a bank product will allow you to measure the exact website conversion.

Do you know on which fields of your applications customers interrupt their filling in or most often make mistakes? Where exactly do they click and do they stop at any of the fields for a longer period? Do you have the flexibility to make changes or A/B tests to see how they affect conversion? What tools do you use to test it?

How to take care of Customer Experience in banking electronic applications?

In order to answer this question, it is best to cite examples of our Customers using the eximee platform.

The validation errors report in the online application showed that many people incorrectly entered the Personal Identity Number. Most likely because they did not have an ID card and tried to enter the number from memory. It turned out that the application was often abandoned because the user did not have an ID card on hand. Problems in this field were a big surprise for the people responsible for CX. They introduced a change: at the beginning of the application they placed information about which data and documents should be prepared in advance. For the bank, the result of this research is also an additional motivation for the implementation of a solution enabling the taking the data from the scan of ID card.

The bank's customers were unpleasantly surprised that only after submitting the application do they learn about the consents they gave during the application process. Banking law and GDPR impose on the bank the need to prepare a long list of consents for its customers. On the electronic application form there are checkboxes next to such a list, which must be ticked in order to give consent. However, in order to save space and not overwhelm the customer with a full-screen text list, the consents are rolled up by default. To view their content, customers must click on the " Unroll" or "Show all content" button next to each consent. For the user's convenience, there is a "I accept all consents" field above the consent list. Selecting it automatically selects all individual consents below. The Bank wanted us to design a new metric for applications - an indicator that will show the percentage of customers who unroll the full content of individual consents. Based on such collected data, the bank will make further decisions on how to change the form of presenting consents to customers in order to increase Customer Experience.

Significant benefit for banks in the Customer Experience measurement.

Let's go back to the beginning of the article for a while. In the first paragraphs we described that marketers use many tools to conduct their researches. However, they are often limited by the lack of possibility to combine data from different sources and draw conclusions based on the processing of such data.

Many banks operate in the similar way, i.e. they have different tools that allow them to create and publish conclusions and then measure conversions from applications. But these tools are not connected and the whole process is not coherent. However, it is the e-banking applications that are the place where banking gets the advantage over the possibilities that marketing has when analyzing websites. The above mentioned limitation does not apply in this case, among other things, due to the possibility of placing simplified marketing consents at the beginning of the application. Electronic applications are too important for the banking sector to be analysed in such a way that their analysis can be divided into several independent solutions. Therefore, the eximee platform, as the only one, is constructed in such a way that it provides mechanisms for creating applications, but also for deep analysis of versions placed on the bank's website. It is one powerful tool for creating and managing applications and also measuring conversions from them.

What data can be collected and analyzed when filling in electronic banking applications?

The analysis of Internet forms should provide full data on the customer's behaviour while filling in the forms. Therefore, it must contain both a general heat map of the application (by tracking mouse movement) and statistics concerning individual fields. That statistics should be collected in sufficient detail to be able to associate statistical data for each form with information entered by a single customer. This makes it possible to capture popular mistakes, but also places where the customer abandons the application or stops because something is difficult for him/her. A/B tests will be ideal to determine whether the planned change will have the expected effect.

The set of events that can be captured includes, among others:

- opening the page

- an exit from the page

- field entry

- en exit from the field

- section Entry

- an exit from section

- change of field value

- validation error

- the mouse cursor is over the field

- the mouse cursor has left the field

- single click

- double-click

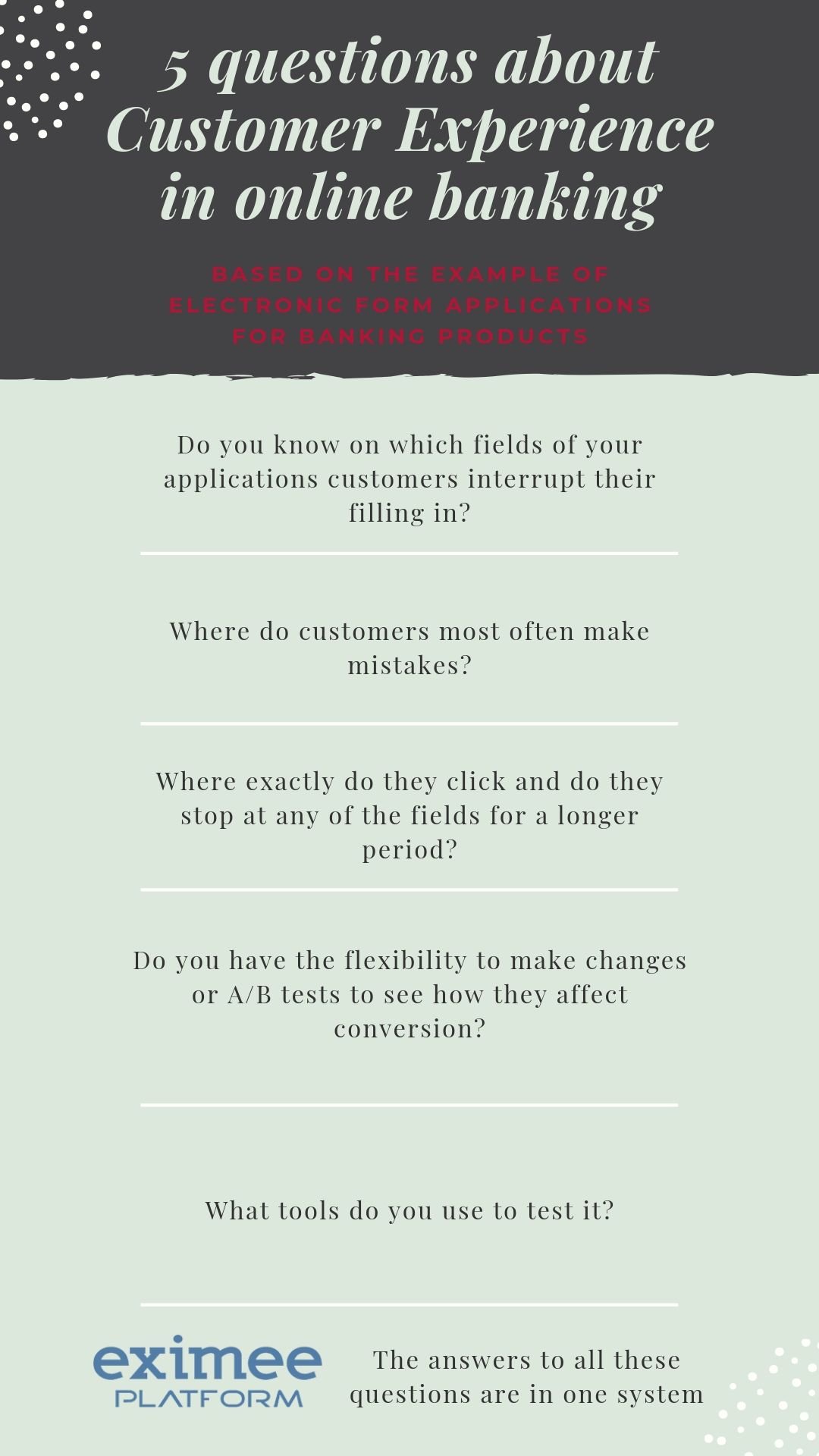

Success Story mBank

Using the applications created by the eximee platform, mBank pays a lot of attention to Customer Experience measurement of its customers while filling in the forms. The Bank regularly reviews its applications and introduces changes. They are dictated by the analysis of, among other things, information about where the largest number of customers abandon the application. In this way, part of the application leading to cross-selling of products was abandoned so that the customer could complete the application more quickly. Similarly, customers were not offered 4 different debit cards to their accounts, as this resulted in the customers' lack of decision-making and abandonment of the application. Proposing one standard debit card increased the conversion percentage. Customer Experience was also examined by comparing the applications for new and existing customers (e.g. those who applied for an account for their children). In this way, the bank created a dedicated page before the application, where the customer chooses whether he is a new customer or already a mBank customer. Such changes also contributed to the positive feelings of customers and increased the conversion of applications.