What do you associate the term Customer Journey with? Probably one of your first associations is CX or UX. However, there are people for whom Customer Journey is more than that. Especially for citizens of countries outside the European Union. For them, coming to Poland and taking up a job here means that you must use the offers of Polish companies and banks, and this gives a new meaning to the concept of Customer Journey.

The increase in the number of non-residents

In 2019, only the number of Ukrainians living in Poland exceeded 190,000. Taking into account other nationalities, we get twice as many. And we are talking only about people who have decided to settle in our country.1 To this should be added employees who work seasonally or rotationally - usually for a few months a year.

What is interesting, however, the analysis of data based on the behaviour of smartphone users reveals a figure close to 1.3 million.2

These people have obvious needs relating to natural aspects of life such as entertainment, banking and communication. These needs force Polish companies to prepare dedicated products. Currently, we observe a rapid increase in the number of products adjusted to the needs of foreigners. Cinemas show films with Ukrainian dubbing, telephones offer packages of conversations to Ukraine, banks expand their offer with accounts for non-residents, and post offices and courier companies introduce special rates for parcels and transfers.

Barriers

While domestic service providers compete against each other in order to gain the highest possible market share, it is worth mentioning a few problems faced by foreigners in Poland.

First of all - the language barrier, which is particularly noticeable in the case of dealing with formal matters in offices, institutions or service points. A client signing a contract must understand and accept a number of consents and statements, which are written in a formal language and are often a challenge even in their native language.

Secondly, formalisms and bureaucratic traps. Portals for foreigners in Poland are a warning: when signing a contract, you should ask the advisor to explain to you exactly what services the contract is signed for. He will often want to sell more products at the same time or extend the agreement with additional options. Be careful.

Thirdly, stress. To what extent do you feel at ease in the Polish office? When reading regulations, especially those written in small print, do you not feel stressed that you are signing something in a haphazard way?

Can these barriers be completely eliminated? Probably not, but you can introduce improvements that will make the barriers less troublesome.

A bank application for a non-resident

Have a look at one example of how a small innovation can radically change the impressions of a bank customer during such a basic activity as opening a bank account.

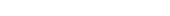

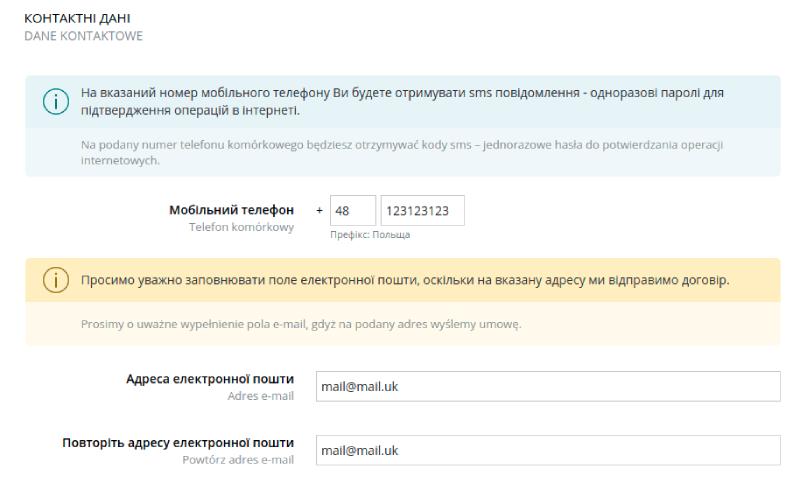

A foreigner in Poland can open an account in a bank branch or in partner branches. In practice, this happens in the following way: A bank advisor meets a potential customer (in this example, let it be a representative of the largest target group, i.e. a Ukrainian). The customer provides the necessary documents and data. The advisor is responsible for completing the application form correctly using a computer or tablet.

An application for an account for Ukrainians is based on an existing application for an account, but is modified to take into account the key formal differences: a foreigner does not have a Polish Personal Identification Number and a Polish ID card. He/she may, however, hold a passport or a residence card and provides additional addresses in the country of origin.

When filling in the application form, it is often necessary for the advisor to explain to the client the meaning of a given field or consent in the application. He or she may use a translation for this purpose. If the application system offers such a dynamic possibility, the client may also change the language of the application from Polish to Ukrainian, then back to Polish and continue filling in the application form.

What are we changing?

Let see this process from the customer's point of view. From this perspective, it is the bank employee who fills in the application on behalf of the customer. Wouldn't the customer feel better if he felt that he was filling in the application together with the advisor, and without language barriers?

As a natural consequence of the above situation, the whole application was created so that it would be bilingual, i.e. all its elements would be displayed in both languages - Polish and Ukrainian - at the same time.

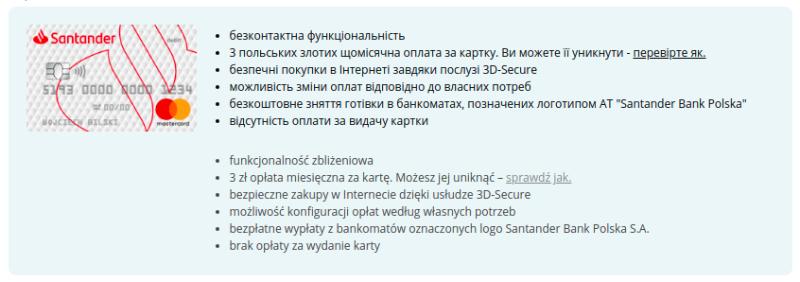

Thanks to this simple procedure, the customer's perception of the interaction with the bank changes completely. The impression of communication turns into a sense of joint action. The bank advisor simply fills in the application together with the client - they look at the same computer screen or tablet. All elements of the application are displayed in both languages - descriptions of cards, glossaries, and consent and statement texts.

The first impression can only be made once

How did the bank's customers react to this change? What can be achieved by this?

Opinions received from advisors leave no doubt - the change was received very positively. The native language on the application form works for the customer's trust to the bank. The first interaction between the customer and the bank become a less stressful experience.

The advisor also feels that his or her working tool is a support for him or her in contact with a foreigner. Remember that also for bank employees the language barrier may be a difficulty while talking to the client.

A journey of a thousand miles begins with a single step3 and this truth can also be applied to Customer Journey. Thanks to a simple change, this first step becomes easier.

1 źródło: Urząd do Spraw Cudzoziemców, stan na kwiecień 2019

2 źródło: Selectivv.com, marzec 2019

3 Lao Tzu