The rapid change in lifestyle caused by the epidemic immediately forced us all to switch to remote access to lessons at school, meetings with friends and colleagues via instant messengers, or the use of electronic circulation of official documents.

In the case of banks, the limitations regarding contact with clients in branches has verified their level of advancement in digital transformation.

This situation strikes not only the effectiveness of acquiring new customers and selling new products to them, but also the serving existing customers.

Let's focus on the latter of the elements listed above. The most important for existing bank clients is the regular service, e.g.:

- dealing with orders related to owned products

- obtaining and forwarding certificates, excerpts and other documents

- solving other problems, e.g. losing a card

and it is this service that is the priority.

To handle any of these cases, usually it is necessary to complete an application, accept it and submit it for execution (hereinafter referred to as placing a bank order).

What can we see when looking at banking?

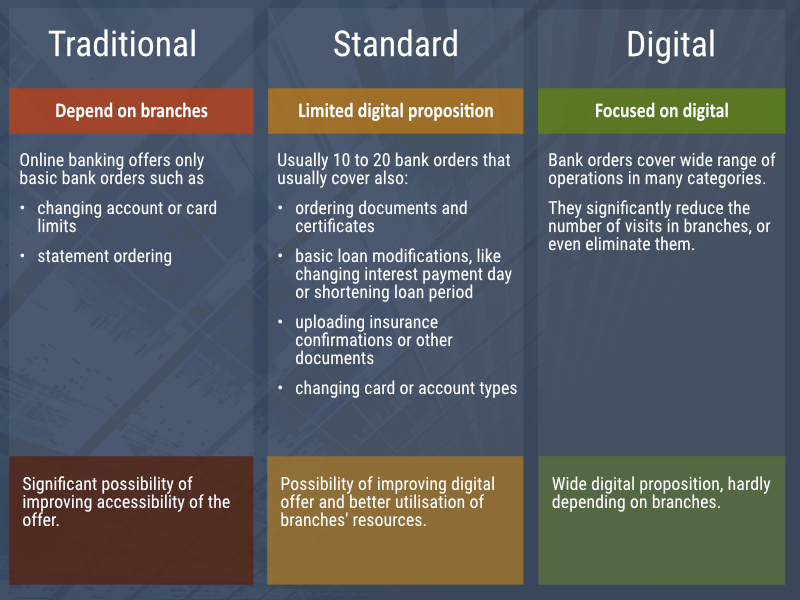

Biorąc pod lupę dostępność cyfrowej obsługi produktów na rynku bankowym, rysuje się wyraźny podział na trzy grupy banków.

Why such differences?

In a perfect world, all banking cases could be dealt with online. Why is this not so?

Even without deep analysis, it is obvious that banks differ not only in financial capabilities, but also in their history, customer service or products offered.

However, let us focus on the two problems regarding electronic requests and instructions that all banks have to face.

- We entered the digital world straight from the world of paper. Suddenly it turned out that translating paper forms into electronic ones is not that easy. And banks need it "for yesterday". Electronic forms have their own rules and it is not possible to transfer them 1: 1 from paper to the screen. You have to redesign them taking into account

- UX capabilities

- habits and possibilities of clients

- legal regulations

- providing online bank orders requires banks to design and implement new service procedures

There is no doubt about the trend though - all banks are increasing their digital proposition, and those that are the most advanced in this can offer the most to customers in a difficult time.

The attack from two fronts

In the case of banks, the virus attacked - in a business sense - from two sides.

First of all - visit branches have become, if not impossible, at least very difficult.

Secondly, the demand for some types of bank order types related to ensuring the safety of bank customers has increased rapidly. These are: Są to:

- temporary suspension of loan repayment

- establishment of a power of attorney to the bank account

- adding a co-owner

- ordering certificates

- forwarding documents to banks

As we can see - they are mostly not the instructions listed earlier as the most popular ones and currently available in digital channels.

Where to look for solutions?

Problem: paper → digital

The whole set of bank orders that a customer can place is even several hundred items. This number depends on the range of products offered.

Fortunately, however, there is a significant subset of this set containing instructions very similar to each other.

They can be reduced to the pattern: "description → document → acknowledgment → acceptance".

Even if for many of them it will be a simplified form, we notice that they will go to manual operation anyway - and therefore we can afford just some kind of simplification in their case. Thanks to them, the workload of implementation significantly decreases, making their implementation possible.

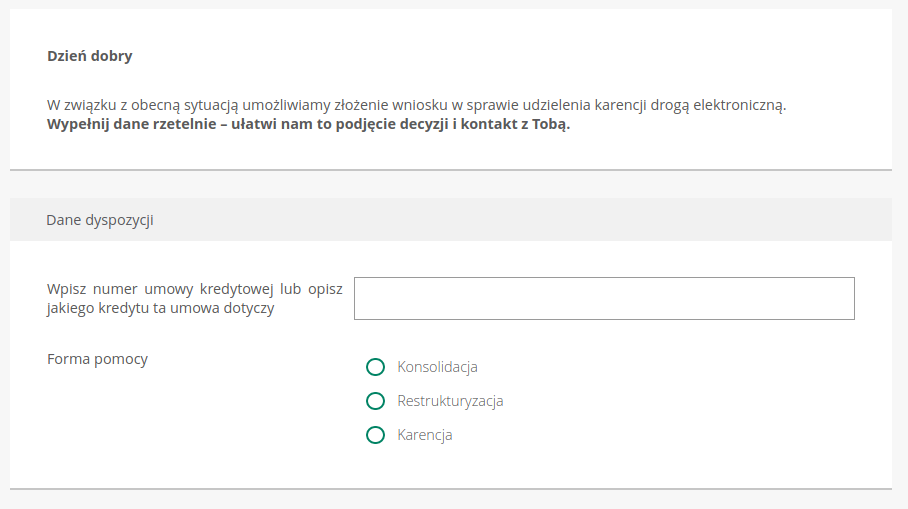

An example of such bank order: application for temporary suspension of loan repayment. Instead of creating widgets for selecting a credit account, integrated with bank's API, the user simply enters the number of the loan agreement into the text field, or even describes it in his words, which is exactly how they would do when in a branch.

According to the "done is better than perfect" principle, we should remember that the goal is to provide the client with a digital bank order (even in a simplified, perhaps temporary form), because the biggest benefit for them is the ability to place the an order without visiting the branch.

With this approach, you can also take advantage of the fact that the similarities allow a component approach to the the forms and many elements can be re-used, e.g.

- data of the logged in person

- authorization component

- file upload

- statements

Problem: handling placed bank orders

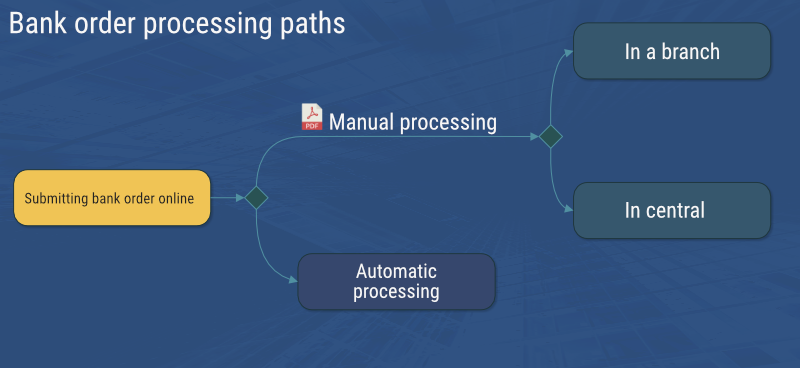

For a bank, making bank orders available online obviously means that they must be serviced in some way. How can these processes be supported?

Of course, it would be best if all orders were processed automatically and an employee was involved only in the case of manual steps that cannot be avoided.

Unfortunately, building automatic mechanisms for several hundred types of bank orders is in many cases unprofitable and impossible.

However, there are other options for handling them.

Manual operation - central

Orders placed by customers are sent to a central service point where employees process them manually.

This involves the need to provide the employees (e.g. via email to the bank's internal mailbox) with the content of the order in a way that enables it to be easily read and entered into the system - for example as a PDF document. This form also makes it easier to archive the application for future verification.

However, a large number of orders placed may quickly exceed the possibilities of handling them by a single group of employees.

Therefore, it is worth considering decentralization of the processing and use other bank resources - branch employees.

Employees whose duties during the epidemic are significantly reduced.

Manual operation - in branches

As in the case of central service, placed bank orders can be made available to branch employees.

How should the system decide which branches the order will go to?

Due to the fact that all necessary customer data are known to the bank (the customer completes the forms as a logged in user) - the parent branch is known. You can also, if the order can be handled by any branch, forward it (e.g. as an email with a PDF attachment containing data from the client's application) to the least busy branch or choose the most suitable branch according to a different key.

Note on this occasion that there are types of orders that require manual handling. For example, a customer who wants to reduce card limits may launch an "anti-churn" procedure - that is, persuading not to give up the bank's offer. As part of such procedures, contact is established to encourage customers to stay with current conditions, or even better conditions are offered.

And what about automation?

Manual processing of clients' orders takes time in branches. on the other hand, automation is expensive and not profitable for all processes.

The implementation of manual processing is easier and can be treated as a temporary solution, it does not close the way to the successive conversion of manual paths to automatic ones. What's more, it buys us some time needed to properly plan the automation of the most cost-effective processes, and then execute this plan under less time pressure.

Customer support

It is also worth mentioning tools that help bank customers efficiently find the right bank order and fill it.

Bank orders in context

Accessing bank orders should be as easy and intuitive as possible. It seems logical to some clients that say the limit change orders should be available with in the account details area, others will look for it on the list of orders, and yet others associate the limits with the parameters of a card, so they will start to look there.

The availability of orders in context means that:

- access to orders is possible from many places - that is from any place where the client may think about placing an order. The role of CX specialists is to design the system in such a way that the customer has all the elements he may think about handy - and even those which he will not think about, but they may use them if they see them.

- customers are shown only those options that are actually available to them - regarding the bank products they have

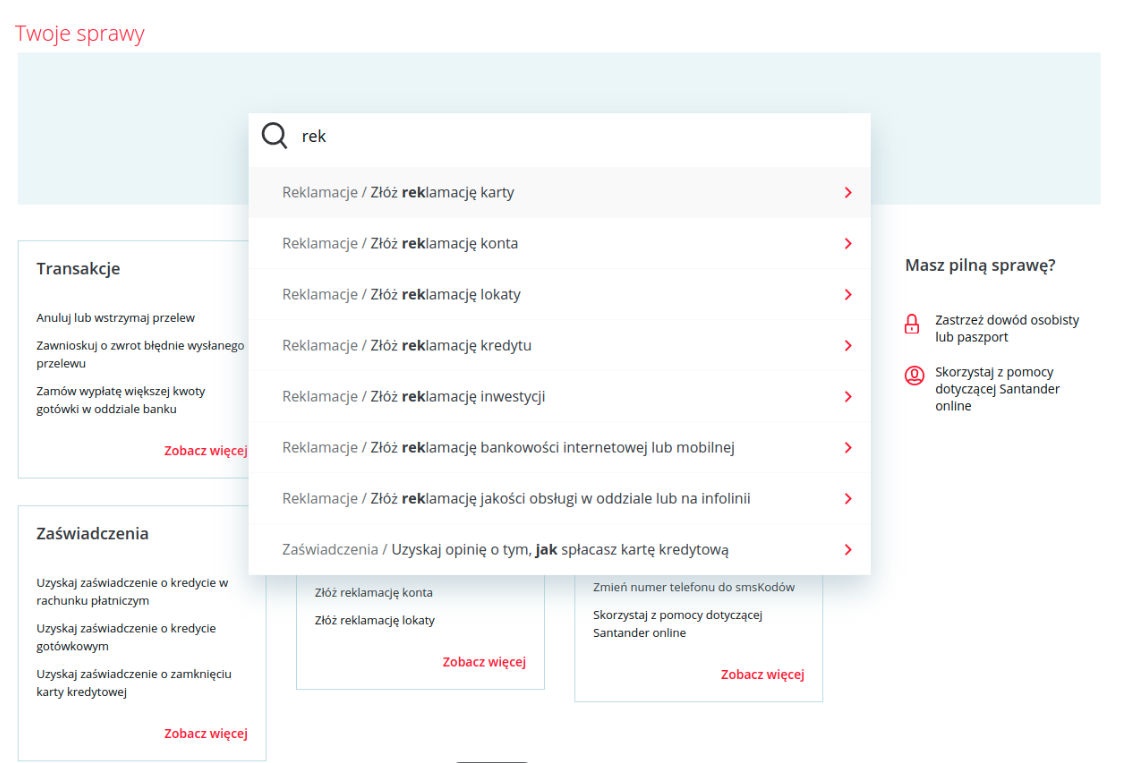

The search engine

Search engines have changed the way data is accessed.

Instead of effective tools for categorizing and organizing our data, we look for effective tools for looking them up.

Search engines allow you to find the right form and start submitting it after entering a few characters of their names, without having to search for them among nested electronic banking options.

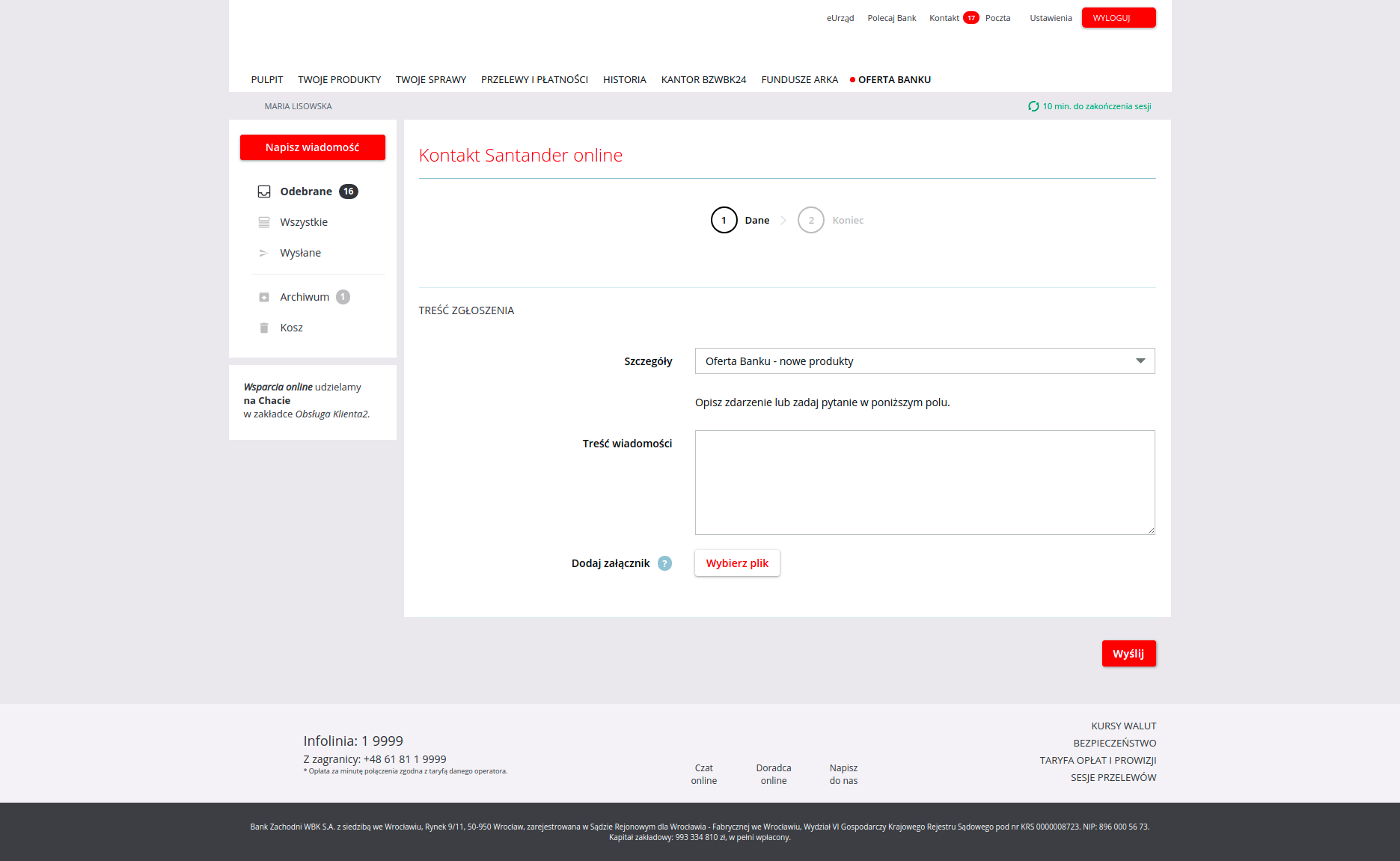

And how to provide materials to the client?

The outcome of the client’s application is very often various documents, such as certificates, statements or confirmations, which must be securely handed over to the client.

There are many solutions (email, traditional mail or a visit to the branch). The best, however, is an electronic mailbox embedded in internet banking.

It not only provides security, but also provides additional functionalities that are not available for traditional mailboxes:

- communication history with bank merged from various channels

- one place where documents such as bank statements, regulations and certificates are located - and there is no doubt that these are actual documents from the bank, not an attempted fraud

- a thread can be started as a message of various forms - it can be text or an electronic form. Then received responses are placed in the same thread. Access to the history makes communication easier, even with an employee who did not participate in this client communication (e.g. from outside the branch)

Summary

The current situation teaches us that the digitization of administration and banking was much more needed for us than we had thought.

But there is also a positive signal. Things that seemed impossible two months ago turned out to be not so horrible - such as using a digital signature or online lessons.

Being in the early stages of the crisis, we can already hear voices about the second wave, which will probably come in the fall.

Therefore, the real goal is not only to survive this crisis, but to prepare for the next one.